Revolutionary Financial Tools

Experience the future of personal finance with our suite of intelligent tools designed specifically for the modern Malaysian lifestyle and regulatory landscape.

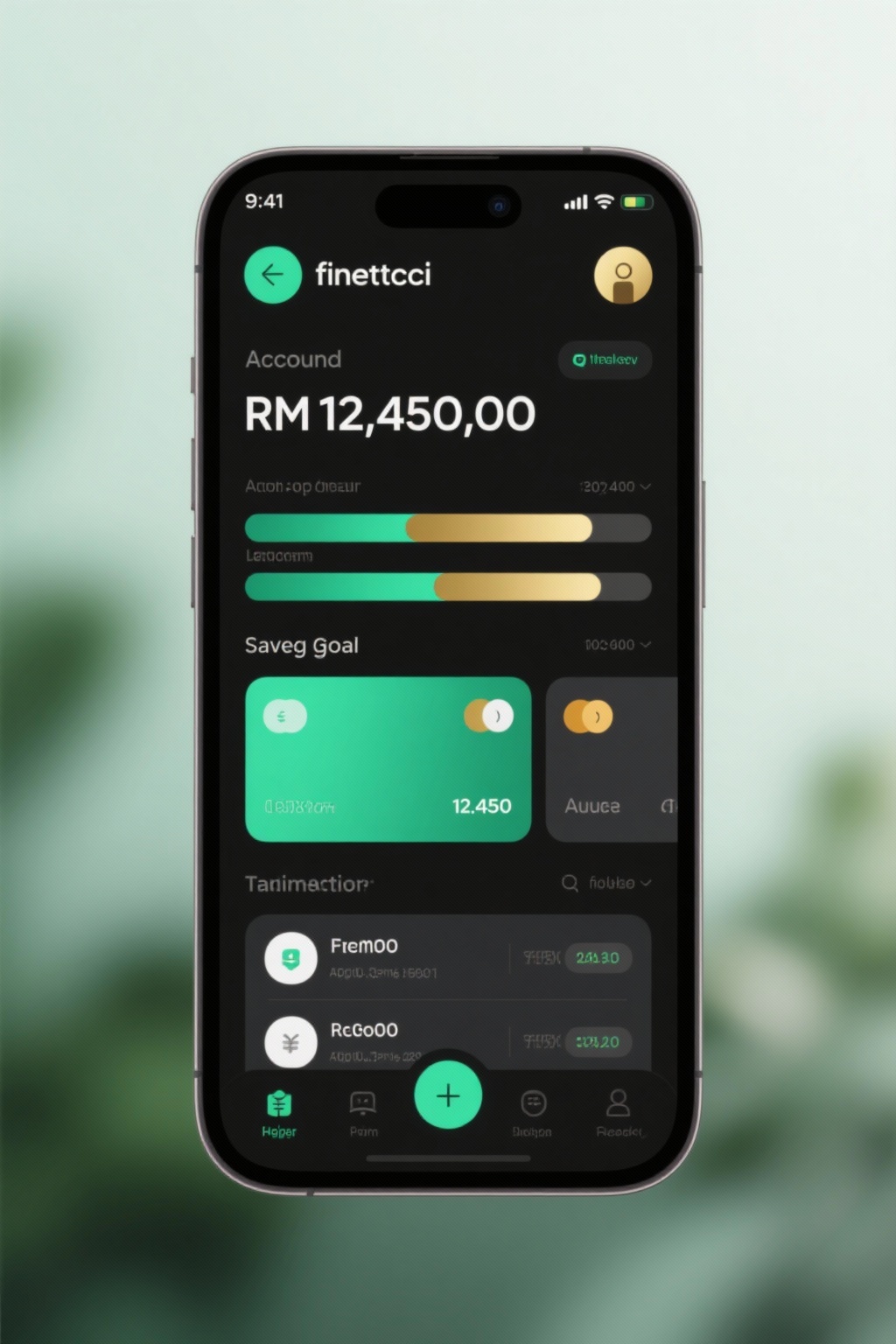

TrimTab™

AI-Powered Expense Optimization

Revolutionary AI technology that analyzes your spending patterns and automatically identifies opportunities to reduce expenses without impacting your lifestyle. Save up to 30% more each month through intelligent recommendations.

Smart Spending Analysis

Advanced algorithms identify unnecessary subscriptions, duplicate charges, and optimization opportunities.

Automated Savings

Set savings goals and let TrimTab automatically optimize your budget to achieve them faster.

Lifestyle-Friendly

Intelligent recommendations that respect your preferences and maintain your quality of life.

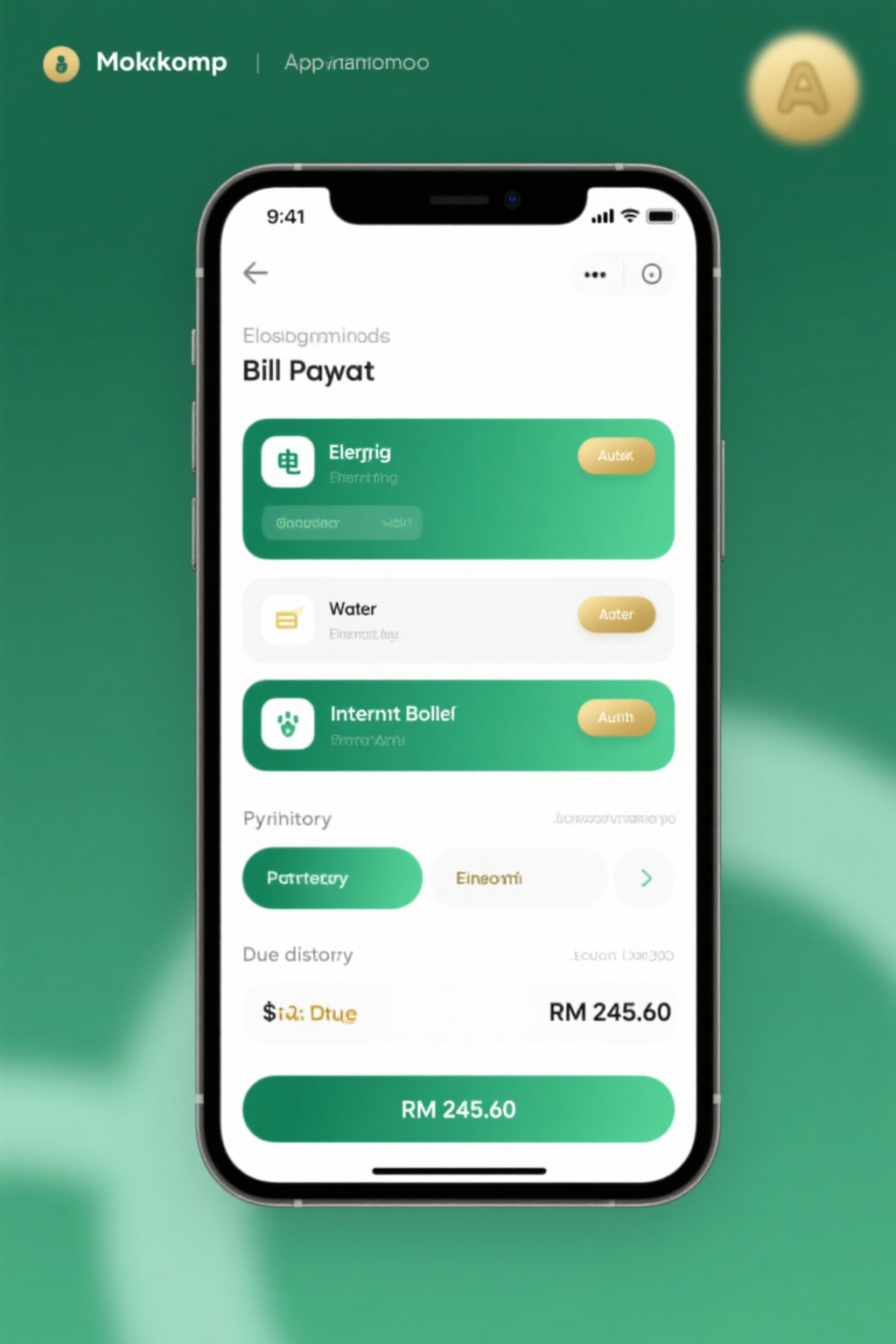

BillBard™

Smart Bill Management

Never miss a payment again. Intelligent bill tracking with predictive scheduling, automatic payments, and comprehensive financial obligation management tailored for Malaysian households.

Predictive Reminders

AI-powered notifications ensure you never miss due dates, with smart reminders based on your payment history.

AutoPay Integration

Secure automatic payments with full control and visibility. Supports all major Malaysian billers.

Spending Analytics

Comprehensive insights into your recurring expenses with trend analysis and optimization suggestions.

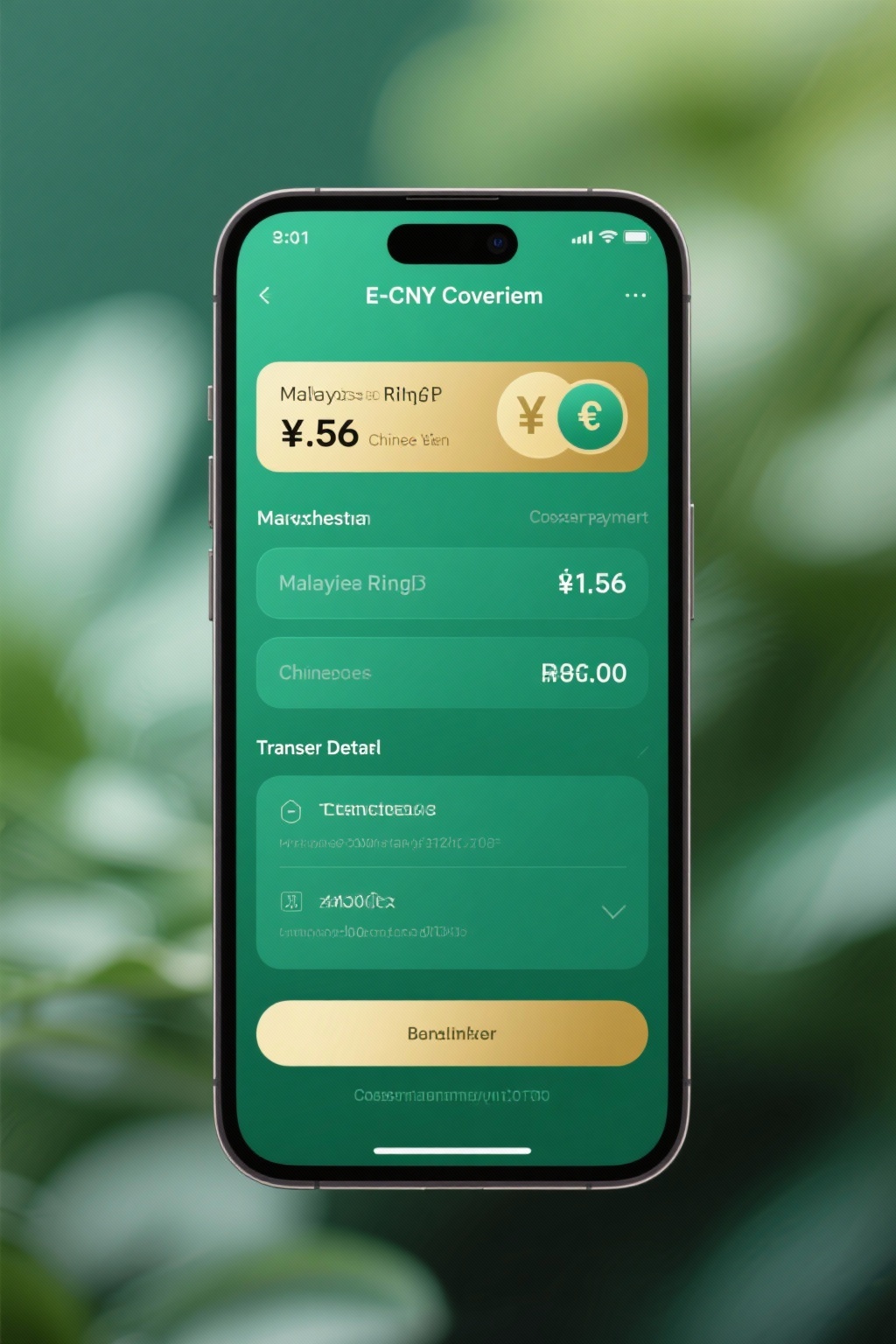

SilkRoute™

Cross-Border e-CNY Integration

Revolutionary cross-border payment solution leveraging China's digital yuan (e-CNY) for instant, low-cost transfers. Bank Negara-approved pilot program connecting Malaysia to the global digital economy.

Instant Transfers

Send money to China in seconds, not days. Real-time settlement with competitive exchange rates.

Transparent Pricing

No hidden fees, no surprise charges. See exactly what you pay before you send.

Regulatory Approved

Bank Negara Malaysia approved pilot program ensuring full compliance and security.

How We Compare

See how WealthAura stacks up against traditional banks and other fintech solutions in Malaysia.

| Feature | WealthAura | Typical Bank | Fintech X |

|---|---|---|---|

| Open Banking Integration | ✓ | ✗ | ✓ |

| e-CNY Cross-Border Payments | ✓ | ✗ | ✗ |

| AI-Powered Expense Optimization | ✓ | ✗ | ✗ |

| Smart Bill Management | ✓ | ~ | ✗ |

| Shariah Compliance | ✓ | ✓ | ✗ |

| BNM Licensing | ✓ | ✓ | ✗ |

| Multi-Currency Support | ✓ | ~ | ✓ |

| Real-Time Notifications | ✓ | ✓ | ✓ |

| Zero Hidden Fees | ✓ | ✗ | ✗ |

| 24/7 Customer Support | ✓ | ✗ | ✗ |

✓ = Full Feature Available | ~ = Partial Feature | ✗ = Not Available

Comparison based on publicly available information as of January 2025. Features and availability may vary by institution.

Why Choose WealthAura?

Experience the difference of a platform built specifically for Malaysian financial needs.

Regulatory Compliant

Fully licensed by Bank Negara Malaysia with complete Shariah compliance certification.

Cutting-Edge Technology

AI-powered insights and machine learning algorithms for personalized financial optimization.

Global Connectivity

First in Malaysia to offer e-CNY integration for seamless cross-border transactions.

Transparent Pricing

No hidden fees, no surprise charges. Complete transparency in all transactions and services.

24/7 Support

Round-the-clock customer support in English, Malay, and Chinese for all your needs.

Lifestyle Integration

Designed for Malaysian lifestyles with support for halal finance and local payment methods.

Ready to Transform Your Finances?

Join thousands of Malaysians who are already experiencing the future of personal finance management.